Digital Financial Information NetworkLet's Track The Market Collapse |

|

Income Property Will Do Worse Than Housing

|

Real Estate Observations and Comments

| Why Are Home Prices Weak | Excess Office Space |

I have been part of housing cycles since

the mid 70s when rental information was a challenge. and price discovery was

very cumbersome.

A Focus on Apartments

We will focus on apartments for our demonstration. The mathematics are the same but the risk differs.

Everyone needs a place to live but retail, industrial and office

buildings are more complex. The economics and risk are very different.

Having said that, I have known people that favored one type of income

property and had no interest in others IE: one likes Industrial and

another may prefer Office.

differs.

Everyone needs a place to live but retail, industrial and office

buildings are more complex. The economics and risk are very different.

Having said that, I have known people that favored one type of income

property and had no interest in others IE: one likes Industrial and

another may prefer Office.

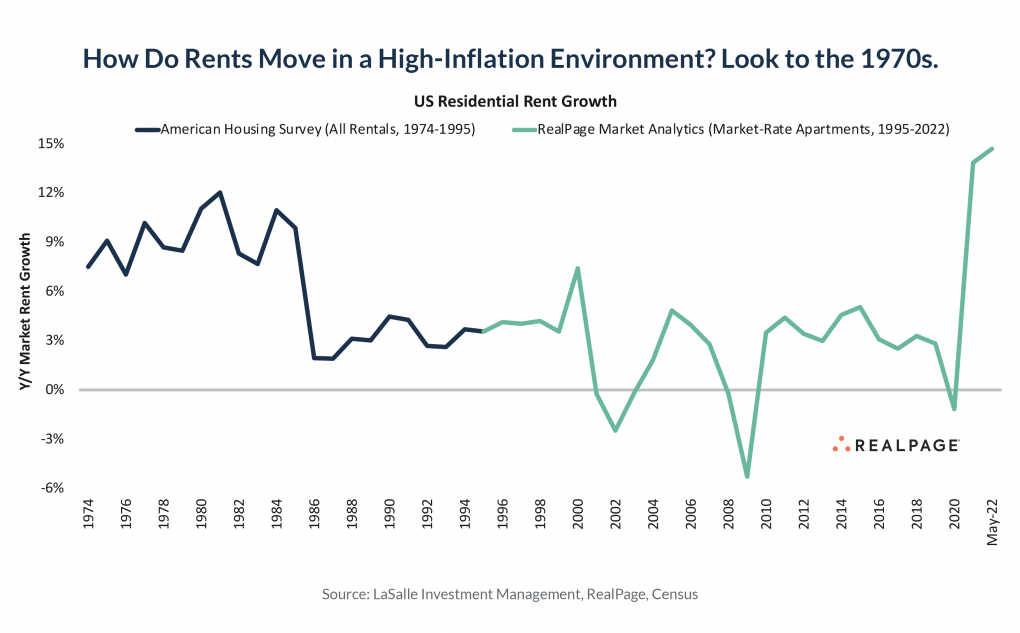

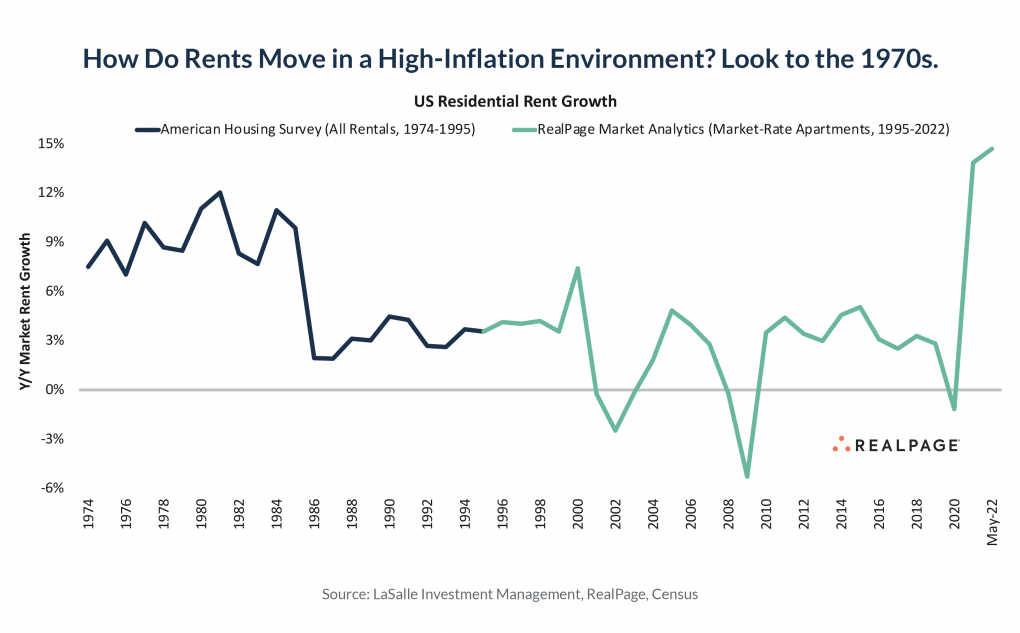

Inflation is an important factor in rents today. The graph on the left illustrates how rents moved with inflation in the high inflation 1970s. How about the recent spike in rates? I expect rents to go negative in the near future before they resume normal increases.

Another risk for income property loans is lenders. Early in my career few banks made apartment loans. The owner of LaJolla Bank started the bank to specialize in apartment lending. Their are more lenders today but in a bad market loans are difficult to secure. Loan underwriters need to factor in lower rent expectations and most likely more vacancies. Smart apartment owners will lower rents to maintain occupancy.

Income property value is a function of Net Operating Income. The interest rate impacts the capitalization rate and the combination of the two, in my opinion, have the biggest impact on value. When interest rates go up, expenses increase and so do Cap Rates.

See the example below.

A Focus on Apartments

We will focus on apartments for our demonstration. The mathematics are the same but the risk

differs.

Everyone needs a place to live but retail, industrial and office

buildings are more complex. The economics and risk are very different.

Having said that, I have known people that favored one type of income

property and had no interest in others IE: one likes Industrial and

another may prefer Office.

differs.

Everyone needs a place to live but retail, industrial and office

buildings are more complex. The economics and risk are very different.

Having said that, I have known people that favored one type of income

property and had no interest in others IE: one likes Industrial and

another may prefer Office.Inflation is an important factor in rents today. The graph on the left illustrates how rents moved with inflation in the high inflation 1970s. How about the recent spike in rates? I expect rents to go negative in the near future before they resume normal increases.

Another risk for income property loans is lenders. Early in my career few banks made apartment loans. The owner of LaJolla Bank started the bank to specialize in apartment lending. Their are more lenders today but in a bad market loans are difficult to secure. Loan underwriters need to factor in lower rent expectations and most likely more vacancies. Smart apartment owners will lower rents to maintain occupancy.

Income property value is a function of Net Operating Income. The interest rate impacts the capitalization rate and the combination of the two, in my opinion, have the biggest impact on value. When interest rates go up, expenses increase and so do Cap Rates.

See the example below.

|

Income Property is all about Net Operating Income (NOI) (Gross Income Less All Expense) |

| Income Property Valuation Fundamentals | |||

| Monthly / Rate | Annual | ||

| Rent ($2,400 Mo Rent) | $2,400 | $576,000 | |

| Expenses | 45% | $259,200 | |

| Net Operating Income (NOI) | $316,800 | ||

| Cap Rate - Late 2021 or Early 2022 | 4% | 4% | |

| Value at a 4% Cap Rate | $7,920,000 | ||

| What if Cap rate is 10% as it has been for most of my career? |

10% | $3,168,000 | |

| Potential Loss In Value | $4,752,000 | ||

Get ready for a big downturn — America's 'office apocalypse' is even worse than expected

Before the pandemic, 95% of offices were occupied. Today that number is closer to 47%. Employees' not returning to downtown offices has had a domino effect: Less foot traffic, less public-transit use, and more shuttered businesses have caused many downtowns to feel more like ghost towns. Even 2 1/2 years later, most city downtowns aren't back to where they were prepandemic. Story by insider@insider.com (Emil Skandul) • Dec 6, 2022 https://www.msn.com/en-us/money/realestate/get-ready-for-a-big-downturn-americas-office-apocalypse-is-even-worse-than-expected/ar-AA14Y5TI

New York City’s Empty Offices Reveal a Global Property Dilemma The rise of remote work will hurt older buildings, leaving landlords in the lurch

In the heart of midtown Manhattan lies a multibillion-dollar problem for building owners, the city and thousands of workers. Blocks of decades-old office towers sit partially empty, in an awkward position: too outdated to attract tenants seeking the latest amenities, too new to be demolished or converted for another purpose. Bloomberg, By Natalie Wong, John Gittelsohn and Noah Buhayar https://www.bloomberg.com/graphics/2022-remote-work-is-killing-manhattan-commercial-real-estate-market/?leadSource=uverify%20wall

San Francisco Braces for Epic Commercial Real Estate Crash

There’s currently more than 25 million square feet of commercial space available for lease or sublease in the city, the equivalent of about 35 Transamerica Pyramids sitting empty.

And a recent report from the Urban Displacement Project ranked the city’s downtown recovery as dead last among more than 60 cities across North America. by Kevin Truong Research by Noah Baustin Contributors Annie Gaus Updated at Sep. 06, 2022 • 12:33pm Published Sep. 06, 2022 • 5:00am https://sfstandard.com/business/san-francisco-braces-for-epic-commercial-real-estate-crash/

Three Hotels Approaching Foreclosure in the Heart of Portland Offer a Warning to City Leaders

“The banks are trying to keep these properties off the foreclosure list, because why would you want to take something back that you know is a bloody mess? But eventually they have to.” By Sophie Peel September 07, 2022 at 5:30 am PDT https://www.wweek.com/news/2022/09/07/three-hotels-approaching-foreclosure-in-the-heart-of-portland-offer-a-warning-to-city-leaders/

|

The Mortgage Rate in America Every Year Since 1972 April 3, 2022: |

|

Back to Search Contact: Gary Lewis Evans; GLE@DFIN.com; 858.210.0486 Copyright Home  |