| Digital Financial Information Network |

|

Economic and Financial Graphics 2022 and Beyond

| Live Graphic Links - Static Graph Links Below | ||

|

St. Louis Federal

Reserve Bank 30 Year Mortgage Rates Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis |

USA Facts Steve Ballmer’s USAFacts releases new stats on American crime, jobs, population, economics and more |

US Government Spending Details Data-driven insights into how governmental revenue and spending affect American lives and programs. Get insight into Congressional and judicial decisions, programs like Medicare, Social Security, foreign aid, and more. |

| 2022 - 2025 | 2026 - | |

| Economic and Financial Graphics - 2022 - 2025 |

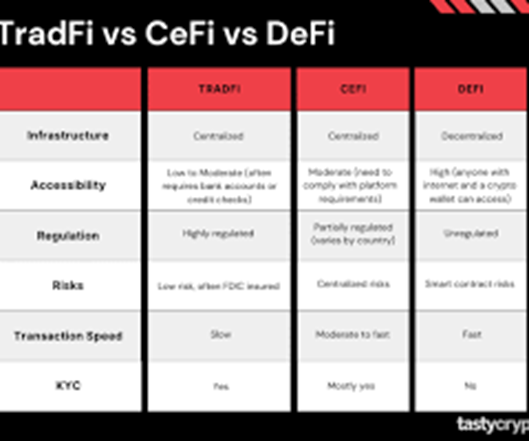

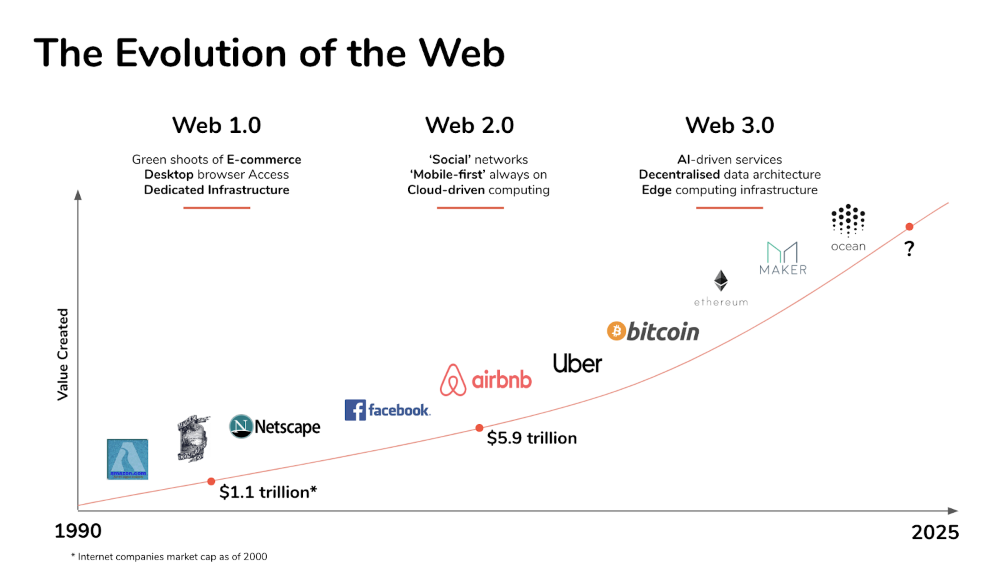

DFIN = Digital Finance which includes the subsets of

TradFi, DeFi and CeFi

In 1996 DFIN.com was created to represent the future of finance which is Digital.

Since that time, three subsets have formed,

1 - DeFi, or decentralized finance, refers to financial services built on blockchain technology that operate without traditional intermediaries like banks.

2 - TradFi, or traditional finance, is the conventional financial system that includes banks, stock markets, and insurance companies. It operates with centralized institutions and is governed by government regulations, which provide consumer protections and market stability.

3 - CeFi, or Centralized Finance, is a financial system that is a hybrid of the above two financial systems. A CeFi finance model may use a custodian model that sacrifices self-custody for convenience and a familiar interface. DFIN favors CeFi but sees value in all systems including systems that we can't imagine that will evolve in the future.

Income Inequality in The United States

https://en.wikipedia.org/wiki/Income_inequality_in_the_United_States#:~:text=Further%2C%20various%20public%20and%20private,%2C%20and%2012.5%25%2C%20respectively

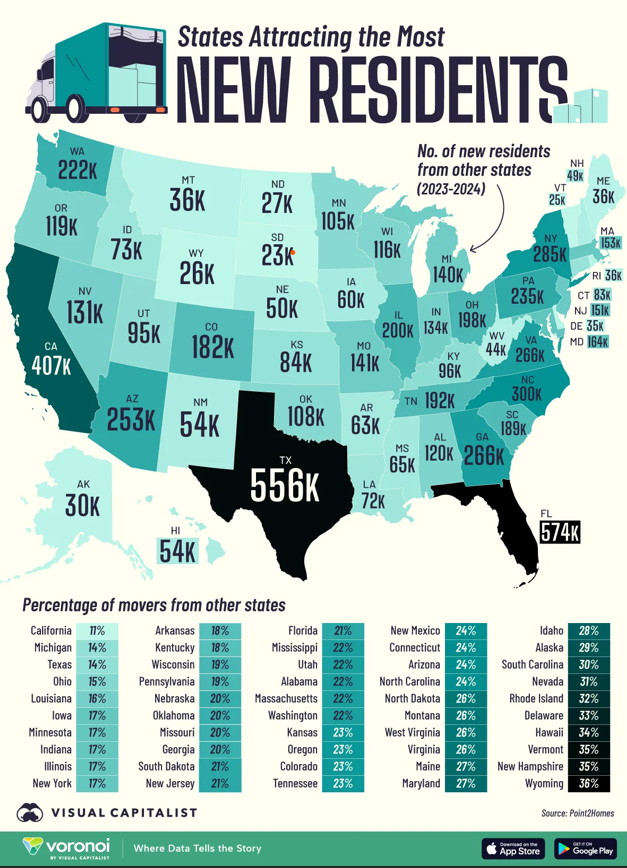

States Americans Are Moving To

This trend won't be ending soon. Many cities and states

have serious spending, debt and budget problems. This

hurts state economics The easy solution is to increase taxes.

Increased Taxes drive people from the state

November 2025 Report

https://www.visualcapitalist.com/ranked-states-americans-are-moving-to/#google_vignette

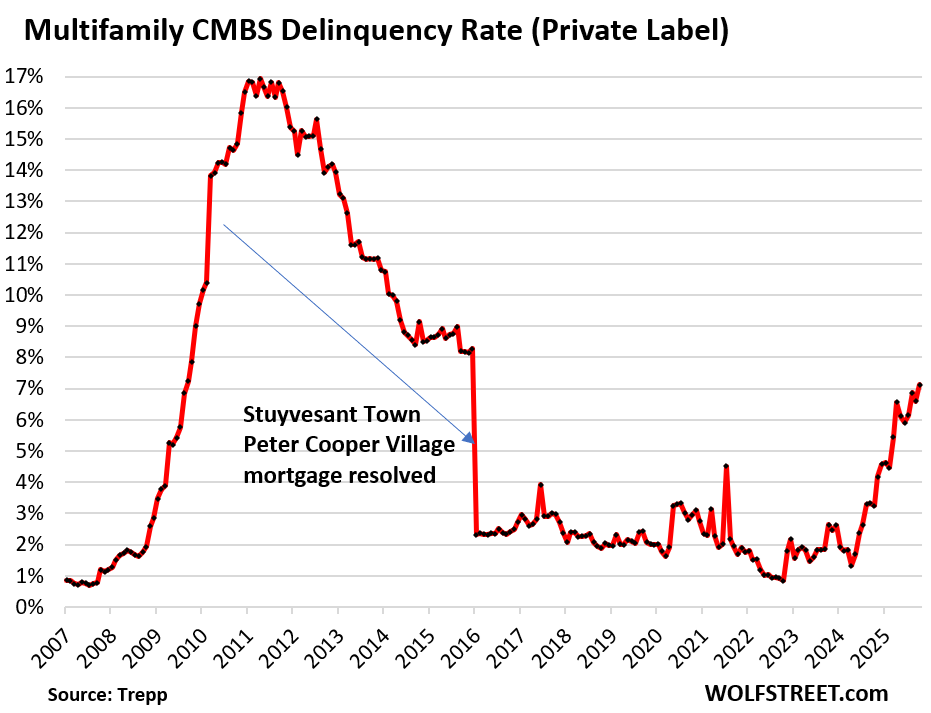

Multifamily CMBS Continue to Deteriorate

This trend is bad and of Note, Commercial MBS is much worse.

November 2025

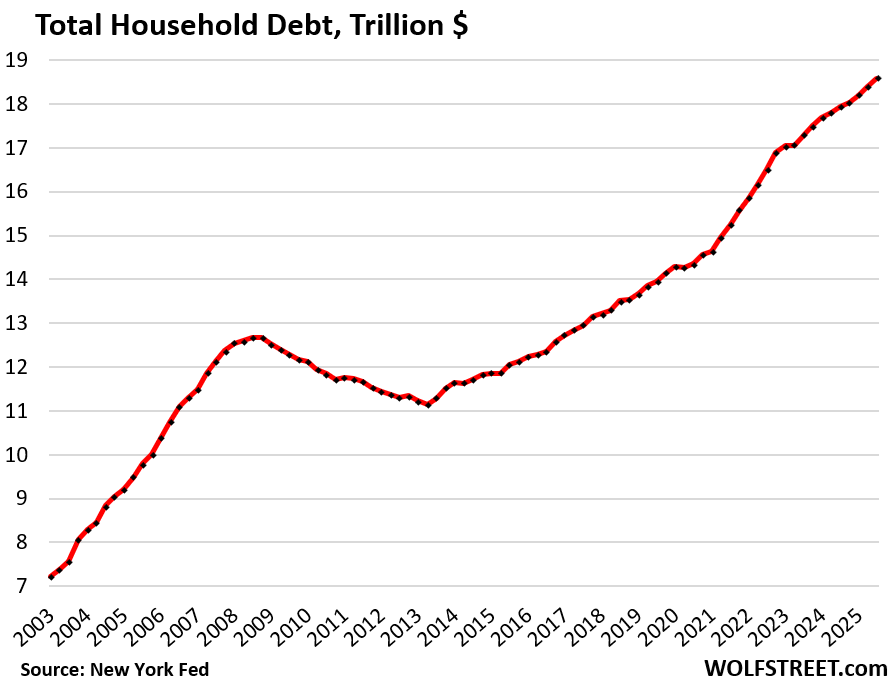

Household Debt Has Been on The Rise

Government is a bad example for all Americans.

November 2025

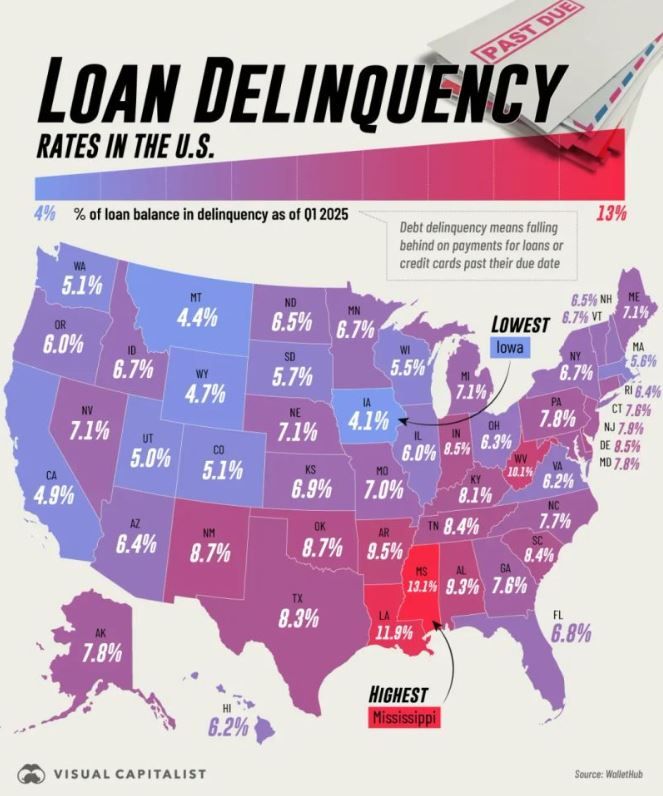

Q1 2025 Loan Delinquency Rates

This is just begining to be a problem.

The Web 1990 - 2025

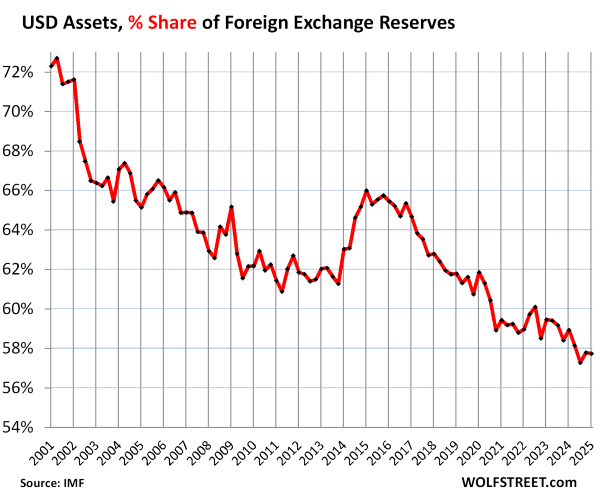

Foreign Governments Are Loosing Fath in The US Dollar

The US was built on a strong dollar. The US $ was the world reserve currency because we had a powerfull economy and low National Debt. A strong dollar is far more than low cost foreign goods and cheap vacations to Europ. In 2025 the worry is tarriffs which is a simple fix if needed. The massive US debt, out of control government spending and a lack of understanding by leaders gives little hope for a solutin. A solution will be painfull. When does excess spending and growing debt work out well?

US Bank Failures Per Year - 1934 to 2016

I expect a new surge. With only about 5,000 banks the absolute numbers won't be as dramatic as in the past but the percentage of failed banks should be similar.

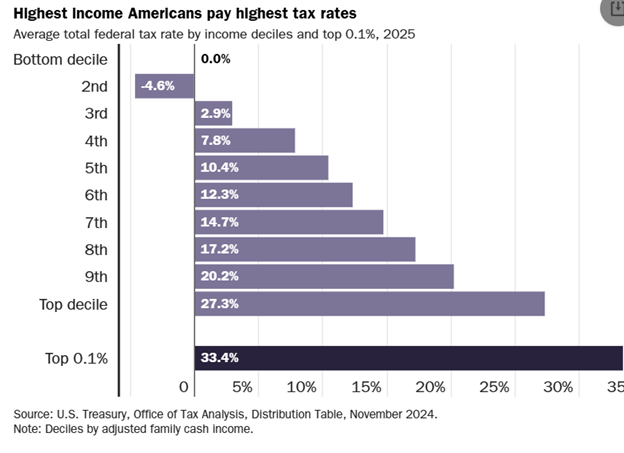

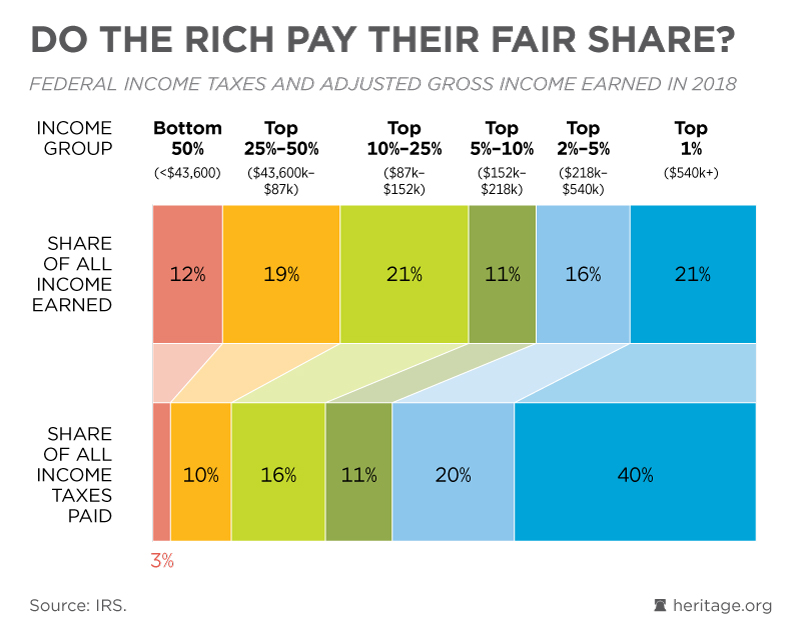

Who Pays The Highest Tax Rates in The US?

Close to 50% of Americans pay no Federal Taxes and the top 1%

pay close to 1 in 3 dollars earned in taxes

Explosive US Energy Needs

The Growing Need for Nuclear Power

This is a big topic in 2025. Ai companies are going into debt to build data centers.

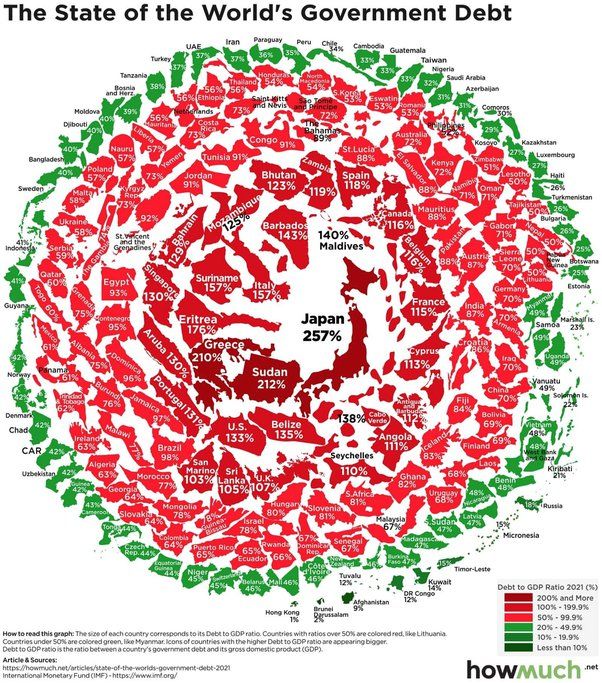

Global Country Debt

The USA is very bad and the countries with a higher percentage are a disaster.

Does anyone remember when Greece had problem refinanceing debt with the EU?

The US Presidents Deportations Reagan Through Biden

Prior to Trump in 2025, Cities and states cooperated and Presidents appeared

to have success.

Deportations Under US Presidents: Surprising Statistics - Infographic Website

An Overview of Deportations Under US Presidents

Deportations in the United States are categorized into two main types: returns and removals. Returns involve sending individuals back without a formal order of removal, often allowing them to leave voluntarily. In contrast, removals are formal deportations where individuals are legally ordered to leave the country. These distinctions are crucial, as different administrations have prioritized these deportation types according to their policy goals, leading to varied statistics under each president.

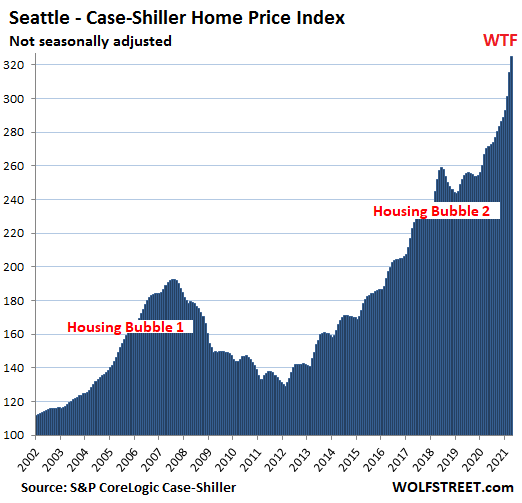

The 2021 - 2022 US Housing

Bubble as

Documented by Case-Shiller Index

|

Seattle Graphic Above - Mortgage Calculator

DFIN expect to see a significant home price correction. See real estate Tab. for analysis.

DFIN demonstrates how a August 2021 $700,000 home sale in Los Angelous, CA may trap owners into the home. When rates go back to 8% the $700,000 purchase may result in a loss in value of more than $200,000.

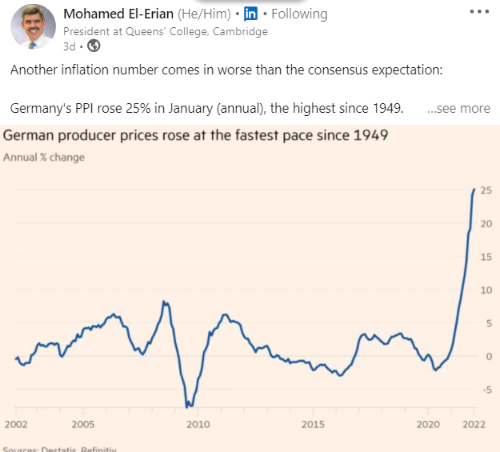

German PPI Up 25% in January

2022

Shutting Down the Economy and Printing Money Will Have Long Term

Consequences

I believe that the USA is still paying the price in

2025

Global Debt Versus Each

Countries GDP

(Debt to Gross National Product)

February 2022

The USA continued explosive growth in debt through

2025 and no end is in site.

Do The Rich Pay Their Fair Share of Taxes?

The lowest 50% of earners, defined as those with

incomes below approximately

$50,339 in 2022, collectively paid 3% of

all federal individual income taxes. Their averag income tax rate

was 3.7% in 2022

|

I couldn't find a chart like this from the 99% but I count on them to refute this data if it is not accurate. They can't refute the data. So if the top 1% earns 21% of income and pays 40% of the tax isn't that enough? The top 10% of earners pay 71% of all federal taxes. I believe it is OK if the bottom 50% of the population only pays 3% or Less.

In Kingdoms and Dictatorships the top 10% would probably have little tax because they were friends of the Kings or ruling class.

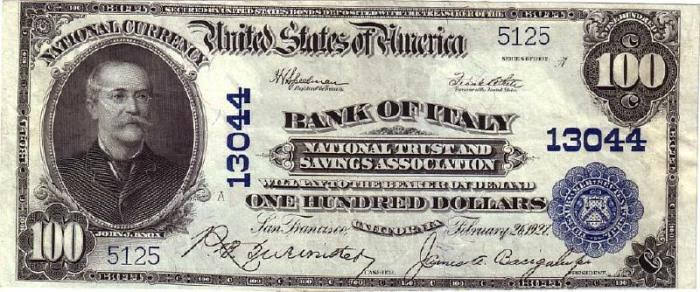

Their Was a Time When Banks Printed

Money

Unlike Crypto Currency Today the

banks typically had hard assets

securing the currency issued.

Think of this money as an IOU. The image below is a Bank of Italy $100 bill. Printed in 1927 just before the banks name was changed to Bank of America. I would argue that this money had greater buying power and was more secure than a US $100 bill today.

HOME

Copyright 1996 - 2025

Please Read This Important Copyright Notice

Founded 1996 San Diego, California, USA

GLE@DFIN.COM