The US National Debt - Information and Analysis The Highest Risk to The USA

It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world; Thomas JeffersonWhy Do We See This as a Problem?History

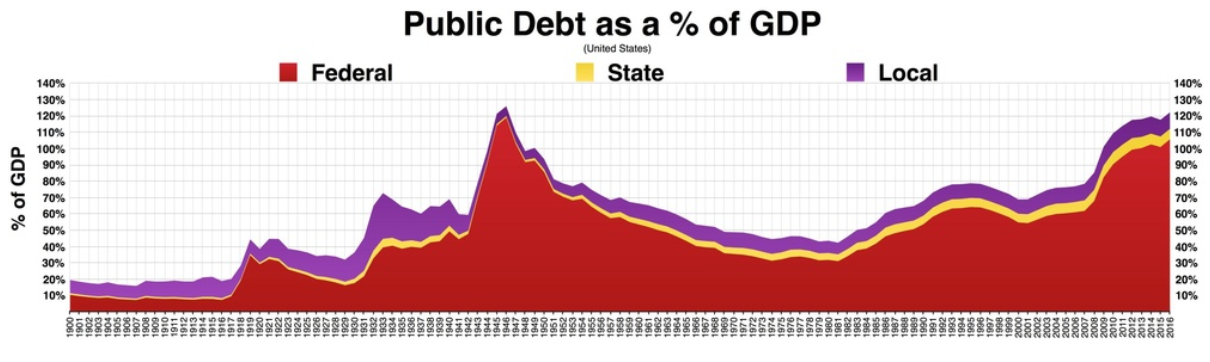

Global Country Debt Problem This will get interesting as debt expands world wide. When debt to GDP exceeds 100% it is a problem. Just like an individual that runs up credit card debt, The payback always hurts and is difficult.

A Libertarian Perspective - Only Five President Did This Damage After Hundreds of Years "The Jefferson administration's enduring achievement was to contain the federal government by restraining its fiscal power. That was Gallatin's work. He abolished internal revenue taxes in peacetime, slashed federal spending, and repaid half of the national debt."

Oil and Natural Gas Prices

in Europe February 2022

|

|

Fortunately

for the nation, Jefferson’s election to the White House in 1800 was the

beginning of the end for the big‐government Federalists. Jefferson and

his Treasury Secretary Gallatin substantially cut the debt before the

War of 1812 intervened. After the war, Jeffersonian leaders pushed once

again to run surpluses and pay down the debt. That anti debt

drive succeeded with the complete extinction of federal debt under

President Andrew Jackson in the mid 1830s. |

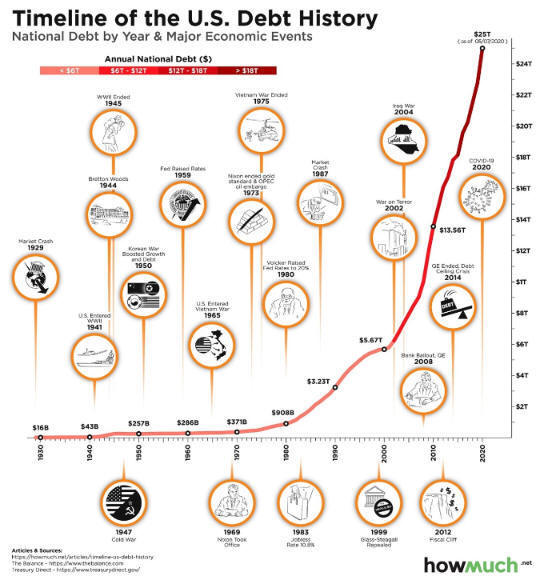

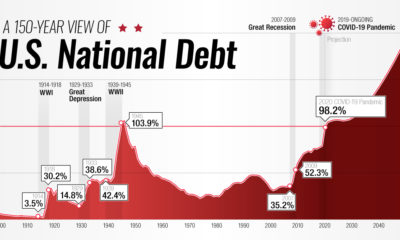

Outside of the Great Depression and WW2 President Johnson changed the game and ramped up spending. Only President Clinton and Newt Gingrich had success in creating a budget surplus for a few years.

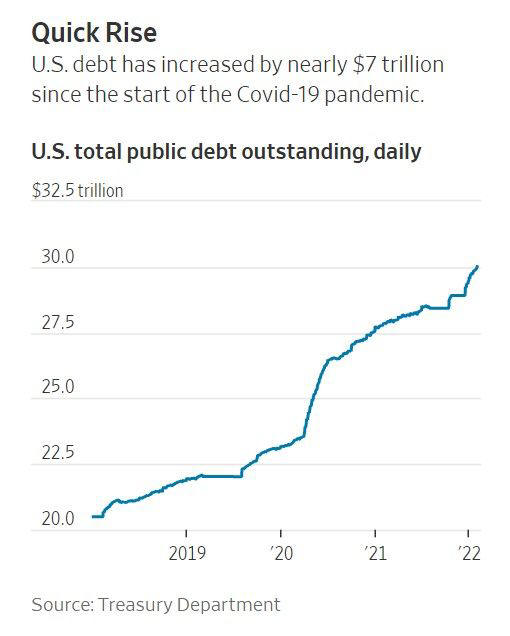

In the mid 1980s the USA accumulated 1 Trillion in debt for the first time. In 2021 US debt will reach about 31 Trillion and we are growing the debt by at least two Trillion per year. This spending is unsustainable.

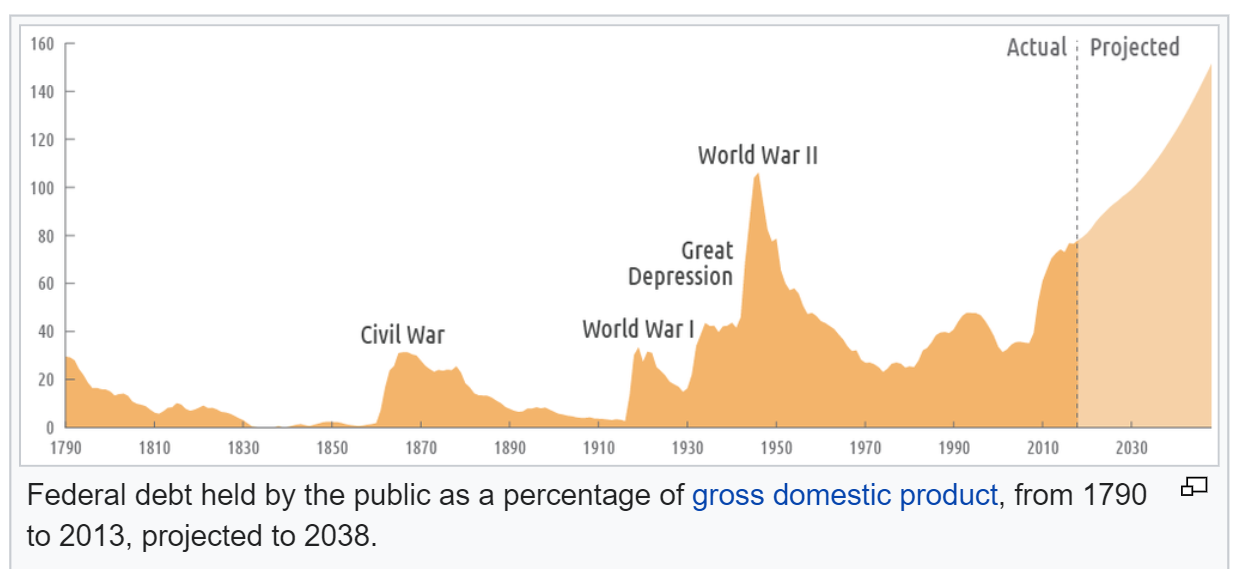

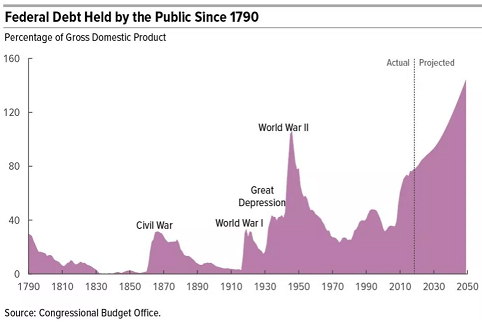

The following Graphic illustrates the total debt outstanding compared to the GNP. It is common belief that 100% is a danger point. I am not that kind. This explosion in debt will be a problem and any delay in gaining control will add to the pain for future generations.

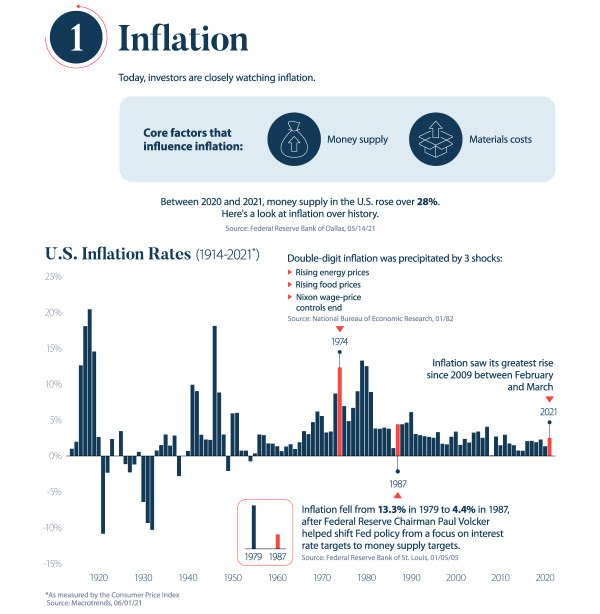

US Inflation - The US Deficit Creates Money and More Money Creates Inflation

In May 2021 the market has growing concern for inflation due to the debt, FRB monetary policy and explosive Fiscal policy. Those with debt and physical assets may be hurt less than average. The low income and poor will be harmed the most.

Global Government Debt is Becoming a Big Problem

Japan has the greatest Debt to GDP ratio but they

traditionally have a high level of citizens holding of the national debt.

Still poor money management but they are not reliant on foreigners and foreign

government. In the past 100% was considerded to be the end.

https://bigthink.com/strange-maps/debt-to-gdp-ratio/

"Fourteen countries fill out the third circle (109%-138%), including some of the largest economies in the world: Canada (109.9%), France (115.8%), Spain (120.2%), and the United States (133.4%), whose debt-to-GDP ratio, according to this map, is just below that of Mozambique. As per the U.S. Debt Clock, America’s debt-to-GDP ratio is just 128%. Still, it’s the same ballpark: the country owes its creditors roughly 1.3 times all the goods and services produced in the U.S. in a year."

Click on Image to enlarge

T

T